Would it astonish you that 70% of executives lack the insight to foresee emerging risks effectively? This alarming figure clearly illustrates that conventional enterprise risk management (ERM) frameworks are finding it difficult to adapt quickly in an increasingly unpredictable business environment. Today's organizations navigate a turbulent risk landscape shaped by forces like shifting consumer demands, new partnerships, fluid ecosystems, morphing industry lines, and disruptive innovations. Risk management needs nimble and future-facing capabilities to stay competitive despite constant market turmoil. But what if you could peer through the haze and address threats before they materialize?

The solution is integrating AI-powered predictive intelligence into ERM frameworks. This powerful combination provides foresight to get ahead of risks before escalation. Leveraging predictive analytics allows organizations to navigate uncertainty and pre-empt emerging threats. Combining AI-driven capabilities with ERM creates a transformative force to reshape risk strategies. This article explores the collaboration of modern predictive and analytical ERM, highlighting how technology leaders can harness it to future-proof their organizations. The predictive ERM model focuses on threats, empowering executives to reshape the risk landscape strategically.

What Is an ERM Framework?

An ERM framework is a structured approach to managing risks across an organization. It provides a bird's eye view of a company's potential threats. The goal is to identify, assess, and mitigate risks before they become full-blown crises.

The ERM framework brings together data from all departments and functions. It gives executives and managers the knowledge to make smart decisions around risk. Implementing an ERM framework takes time and commitment. But it equips organizations to address uncertainty head-on. An effective ERM framework is a proactive early warning system against the biggest threats.

With the proliferation of ERM frameworks, determining the optimal approach for your organization can be challenging. Careful assessment of business needs and leveraging advanced AI-driven predictive intelligence capabilities are required to select the right framework, followed by meticulous implementation to maximize value.

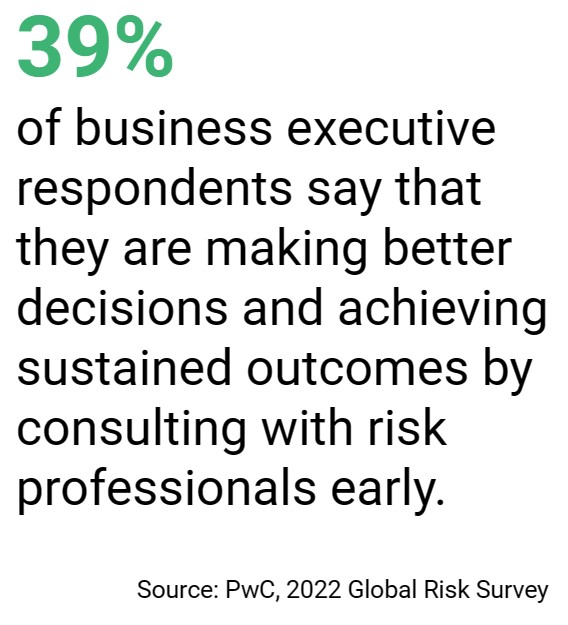

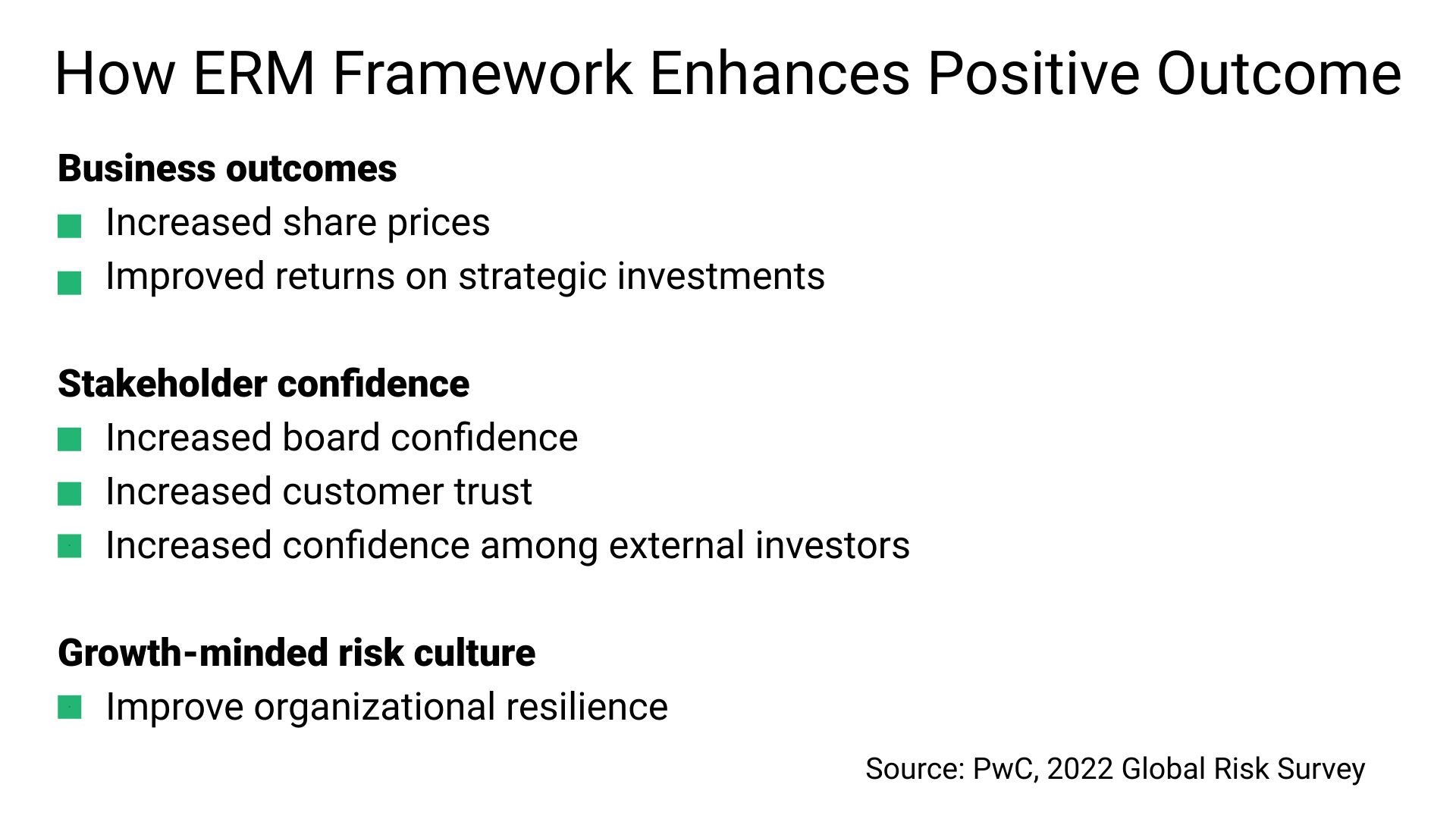

(This graphic is derived from the 2022 PwC Global Risk Survey data, which includes responses from 3,584 professionals from various industries.)

Why Is Building a Robust ERM Framework Important?

Unlike traditional reactive risk management, ERM takes a forward-looking approach to identifying risks and opportunities. By evaluating threats with corporate strategy, ERM enables organizations to avoid risks before they become costly problems.

Leading organizations are embracing the ERM framework to:

- Avoid losses through proactive risk mitigation,

- Facilitate strategic decisions aligned with risk appetite,

- Promote accountability by assigning risk ownership,

- Foster a culture of compliance across the enterprise.

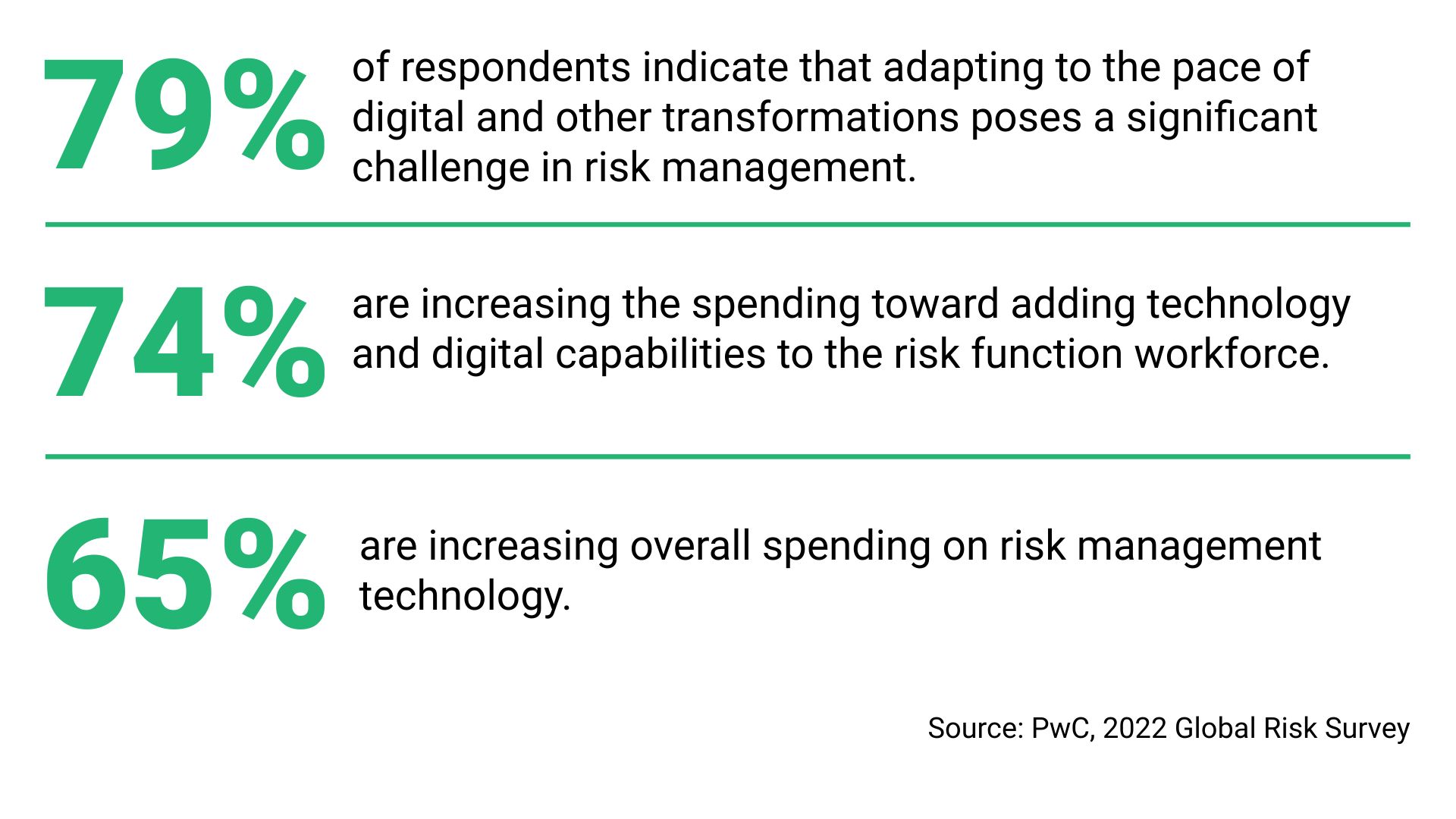

(This graphic is derived from the 2022 PwC Global Risk Survey data, which includes responses from 3,584 professionals from various industries.)

The comprehensive view provided by the ERM framework empowers organizations to create value by optimizing risk-taking rather than avoiding it altogether. However, realizing these benefits requires the right framework tailored to business needs combined with the power of modern business intelligence solutions.

Components of a Robust ERM Framework

An effective ERM program comprises several key components. The company culture, governance, and values are crucial in establishing a risk-aware culture. This ensures that risk management is embedded in the organization's DNA and that employees at all levels understand their role in identifying and addressing risks.

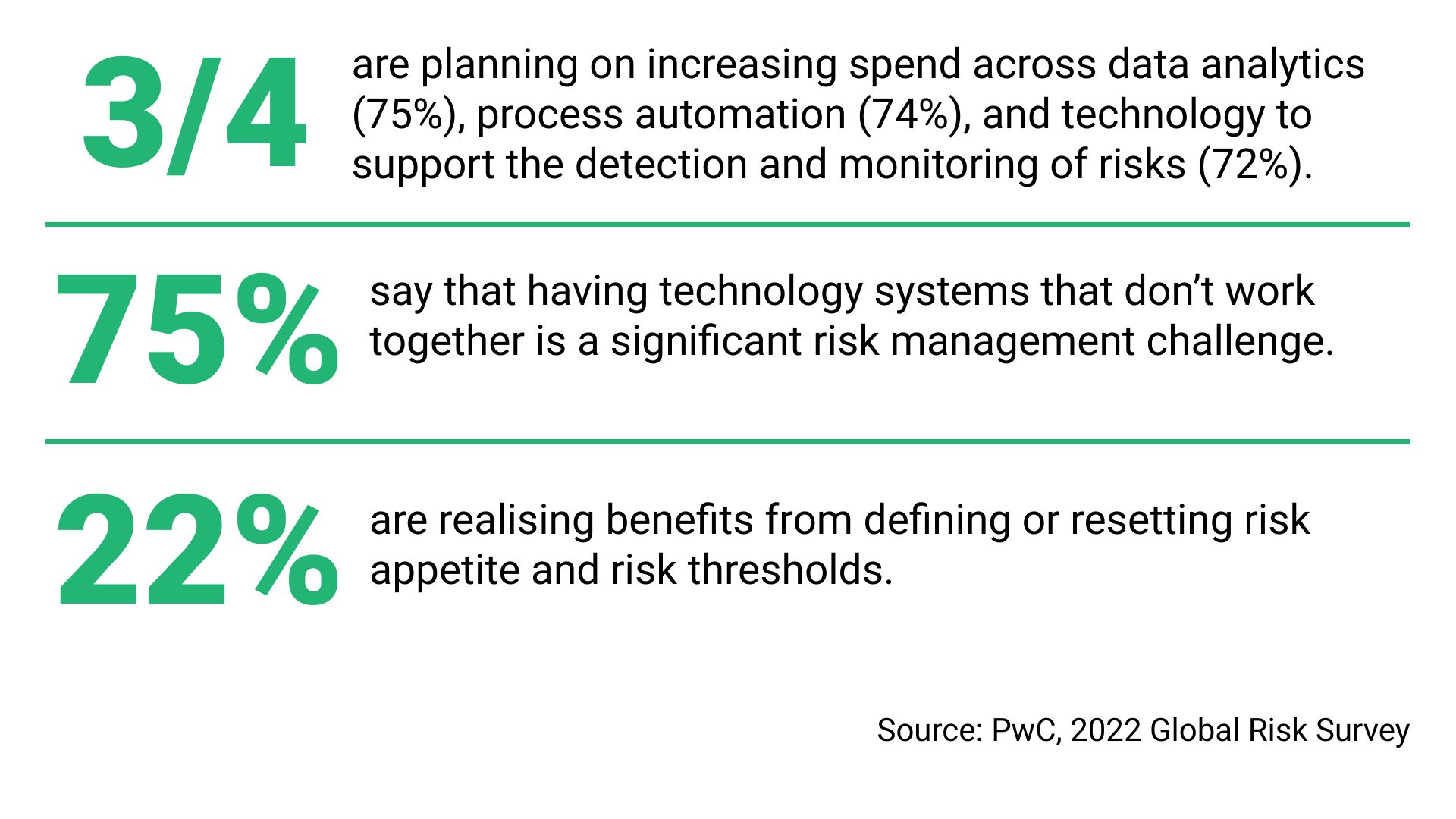

(This graphic is derived from the 2022 PwC Global Risk Survey data, which includes responses from 3,584 professionals from various industries.)

Strategic planning, objectives, and goal setting are also essential components of the ERM framework. By aligning risk management with business objectives, organizations can prioritize their efforts and resources to address the most significant risks that may impact their ability to achieve strategic goals.

The risk management cycle, which includes risk identification, assessment, response, and monitoring, is another crucial aspect. Organizations need to continuously evaluate their risk landscape, identify emerging risks, and develop appropriate response strategies to mitigate or seize opportunities with the help of advanced analytical solutions.

Transparency, communication, and reporting complete the structure of an ERM framework. Clear communication channels and effective reporting mechanisms ensure that risk-related information is shared throughout the organization, enabling stakeholders to make informed decisions based on accurate and timely information.

Elements Of an Effective Enterprise Risk Management Strategy

In today's ever-evolving risk landscape, a proactive approach enabled by the ERM framework is indispensable. With careful framework selection and meticulous execution, organizations can unlock immense value.

approach enabled by the ERM framework is indispensable. With careful framework selection and meticulous execution, organizations can unlock immense value.

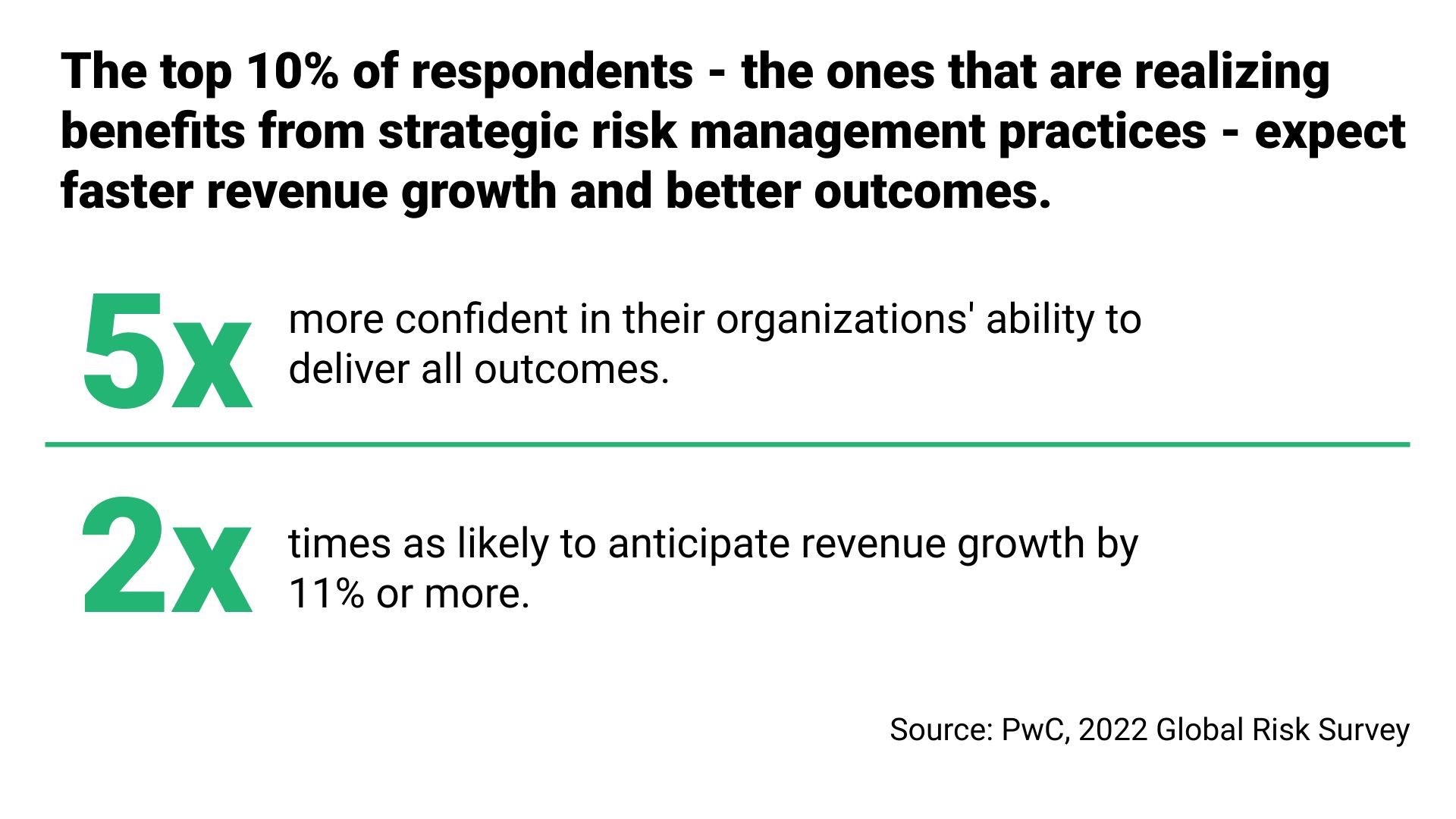

(This graphic is derived from the 2022 PwC Global Risk Survey data, which includes responses from 3,584 professionals from various industries.)

An effective ERM framework requires coordinating various elements into a cohesive program. As organizations develop an ERM strategy, key aspects to consider include:

- Revenue Drivers - The ERM framework should safeguard the specific products, services, and operations that generate revenue. Understanding risk exposures within key value drivers enables targeted mitigation.

- Corporate Strategy - Along with current revenue sources, emerging strategic initiatives per the corporate plan must also be incorporated to manage risks holistically across the business.

- Risk Identification - Comprehensively identify existing and potential risks across the enterprise that could impede strategic goals. Leverage AI data-driven analytical solutions to uncover hidden threats early.

- ERM Components - The ERM strategy should address all elements including culture, objectives, risk assessments, controls, and reporting. Seamless coordination between components creates a resilient program.

- ERM Framework - The strategy provides the blueprint for executing the risk management plan. An ERM framework like COSO or ISO 31000 provides a structure for implementation.

- Reporting and Monitoring - Ongoing reporting provides visibility into ERM framework effectiveness, enabling strategy refinement over time as the risk landscape evolves using resilient AI-powered business solutions.

- Maturity Model - As the ERM program matures in sophistication, the strategy may also evolve. Maturity models like RIMS RMM provide development pathways.

(This graphic is derived from the 2022 PwC Global Risk Survey data, which includes responses from 3,584 professionals from various industries.)

A united strategy integrating these elements enables organizations to anticipate threats, unfold opportunities, and navigate uncertainty powered by modern analytical solutions.

By taking a data-driven and forward-looking approach, the ERM strategy is the foundation for a vigilant, agile risk management program ready for the future. Key tenets of an evolved ERM strategy include:

a vigilant, agile risk management program ready for the future. Key tenets of an evolved ERM strategy include:

- Enterprise-wide perspective of risk exposures,

- Focus on strategic goals and value creation,

- Proactive identification of emerging threats,

- Seamless coordination between risk activities,

- Continual monitoring and real-time adaptation,

- Leveraging advanced analytics and AI.

Organizations can transform ERM from a cost center into a strategic asset with a comprehensive and resilient strategy guiding activities. The time for siloed reactive risk management is over. The future belongs to integrated, predictive solutions powered by strategic ERM strategy.

How to Develop an Enterprise Risk Management Framework

Building a robust enterprise risk management (ERM) framework is crucial for organizations seeking to address threats proactively. An effective framework provides a structure for executing risk strategies, ensuring rigorous oversight. When developing an ERM framework, key steps include:

- Assemble a Steering Committee - Secure executive sponsorship to signal the importance of ERM and determine accountabilities across the framework.

- Align on Risk Perspectives - Establish common risk terminology and assessments to minimize inconsistencies in how threats are addressed across the organization.

- Define Roles - Articulate responsibilities at all levels, from the board and leadership to business units and frontline personnel. Risk teams play a central role, but ERM requires enterprise-wide engagement.

- Identify Risks - Catalog organizational risks through collaboration between business units and risk management. Assess likelihood, impact, controls, and mitigation strategies. Leverage data-driven analytical solutions to uncover hidden threats early.

- Document Risks and Appetite—Formalize risk assessments into statements specifying tolerances and priorities. Clarify which risks to avoid, accept, or embrace.

- Prioritize Risks - Order risks based on criticality to focus resources on mitigating unacceptable exposures.

- Establish ERM Methodology - Implement consistent processes and terminology for enterprise-risk activities. Rather than building from scratch, adapt proven frameworks like COSO.

- Monitor and Report - Continuously track risks and re-evaluate the framework as conditions evolve. Embed agility to address emerging threats revealed through modern analytical solutions.

With sustained commitment from leadership and vigilance powered by advanced analytics, organizations can transform ERM frameworks into strategic assets that build resilience. Proactive risk management driven by robust frameworks is indispensable in navigating today's turbulent landscapes.

Examples: Leading Enterprise Risk Management Frameworks

Implementing a robust ERM framework necessitates a customized structure. There are several options, each with unique strengths:

- CAS ERM Framework - Offers risk resources for financial firms, developed by actuarial associations.

- COSO ERM Framework - Aligns with SOX compliance, mostly used by public companies, and emphasizes strategy integration.

- ISO 31000 - An adaptable international standard that provides customizable risk principles and processes across sectors.

- NIST Framework - Focuses on cyber risks for government contractors and complements other NIST standards.

- COBIT Framework - Bridges technology and strategic risks, created by an information systems audit association.

- RIMS RMM Framework - Benchmarks risk management maturity and identifies improvement opportunities.

ERM frameworks provide an essential blueprint for executing risk strategies. But as disruption accelerates, AI-driven agility is equally vital. Organizations must implement robust frameworks and equip teams to uncover risks proactively. Risk management can accelerate from reactive to predictive with the right framework and analytical capabilities. That shift is imperative for organizations seeking resilience in turbulent times.

Conclusion

In conclusion, creating a robust ERM framework is crucial in the rapidly evolving business environment. In the fast-paced business world, a robust ERM framework is essential. It provides a systematic approach to risk management, ensuring consistency and a comprehensive understanding of potential risks, thereby safeguarding revenue. The ERM framework facilitates strategic decision-making, promotes accountability, and fosters a culture of compliance. To manage pervasive organizational risks, it’s crucial to integrate the ERM framework with strategic approaches and modern business solutions, rather than managing risks in isolation.

Incorporating predictive intelligence into the ERM framework significantly boosts its effectiveness by enabling proactive risk management. TrueProject, a SaaS-based predictive intelligence solution, augments the ERM framework by providing real-time risk detection, AI-powered data-driven scenario exploration, and complete project visibility. This integration allows quick threat responses, informed decision-making in uncertain situations, and optimized project management processes. By integrating these capabilities into an ERM framework, TrueProject assists organizations in effectively anticipating and managing risks. It provides oversight and a real-time snapshot of project health. This proactive approach to risk management leads to successful project outcomes and helps organizations achieve their strategic objectives.

More information on TrueProject at https://trueprojectinsight.com

About the Author:

Nisha Antony is an accomplished Senior Marketing Communications Specialist at TrueProject, a leader in predictive intelligence. With over 16 years of experience, she has worked as a Senior Analyst at Xchanging, a UK consulting firm, and as an Internal Communications Manager on a major cloud project at TE Connectivity. She is an insightful storyteller who creates engaging content on AI, machine learning, analytics, governance, project management, cloud platforms, workforce optimization, and leadership.

Endnotes

- Jay Cameron. “What is enterprise risk management (ERM)? Definition, strategy & frameworks.” Deligient: Dec 05, 2023. https://www.diligent.com/resources/blog/erm

- Mitchell Nazarov. “Enterprise Risk Management (ERM) Fundamentals.” Audit Board: Aug 08, 2023. https://www.auditboard.com/blog/enterprise-risk-management/

- PwC Team. “2022 Global Risk Survey.” PwC: 2022. https://www.pwc.com/us/en/services/consulting/cybersecurity-risk-regulatory/library/global-risk-survey.html